44 what coupon rate should the company set on its new bonds if it wants them to sell at par

Solved Uliana Company wants to issue new 18-year bonds for | Chegg.com Uliana Company wants to issue new 18-year bonds for some much-needed expansion projects. The company currently has 9 percent coupon bonds on the market that sell for $1,045, have a par value of $1,000, make semiannual payments, and mature in 18 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? Finance 300 Exam 2 Flashcards - Quizlet Heginbotham Corp. issued 15-year bonds two years ago at a coupon rate of 7.9 percent. The bonds make semiannual payments. If these bonds currently sell for 109 percent of par value, what is the YTM? N = 26 I/Y = ? PV = 1090 PMT = 79/2 FV = 1000 I/Y = 3.422 You find a zero coupon bond with a par value of $10,000 and 19 years to maturity.

7.6-7.7 Bonds: Inflation, Interest Rates,and Determinants of ... - Quizlet the ease in which an asset can be converted to cash without significant loss of value RWB Inc., has 6% coupon bonds on the market that have 10 years left to maturity. The bonds make annual payments. If the YTM on these bonds is 11%, what is the current bond price? A. $705.54 B. $1,000.00 C. $1,061.61 D. $1,134.11 E. $1,368.00 A. $705.54

What coupon rate should the company set on its new bonds if it wants them to sell at par

Chamberlain Co. wants to issue new 20-year bonds for some much-needed ... The company currently has 6 percent coupon bonds on the market that sell for $1,083, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? simranstory9180 is waiting for your help. Add your answer and earn points. Expert-verified answer jepessoa Answer: 5.36% Business Finance Ch6 Quiz - Connect Flashcards | Quizlet Coupon payment = (1000 x 7.9%x50%) Coupon payment = 39.5 Number of periods = 13 x 2 Number of periods = 26 Periodic YTM = 5.6%/2 Periodic YTM = 2.8% Price = -PV (rate,nper,pmt,fv)) Price = -PV (2.8%,26,39.5,1000) Price = 1,210.40 You purchase a bond with an invoice price of $1,145. Seether co wants to issue new 20 year bonds for some - Course Hero Seether Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 8 percent coupon bonds on the market that sell for $930, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? →8.75%.

What coupon rate should the company set on its new bonds if it wants them to sell at par. Coupon Rate the Company Should Set on Its New Bonds 418233 Bond coupon rate and yield to maturity Not what you're looking for? Search our solutions OR ask your own Custom question. A company currently has 10 percent coupon bonds on the market that sell for 1,063, make semiannual payments, and mature in 20 years. Bond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond ... OneClass: Chamberlain Co. wants to issue new 20-year bonds for some ... Seether Co. wants to issue new 13-year bonds for some much-needed expansion projects. The company currently has 9.8 percent coupon bonds on the market that sell for $868.69, make semiannual payments, and mature in 13 years. What coupon rate should the company set on its new bonds if it wants them to sell at par Chamberlain Co. wants to issue new 20-year bonds for some Chamberlain Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 7 percent coupon bonds on the market that sell for $1,083, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par?

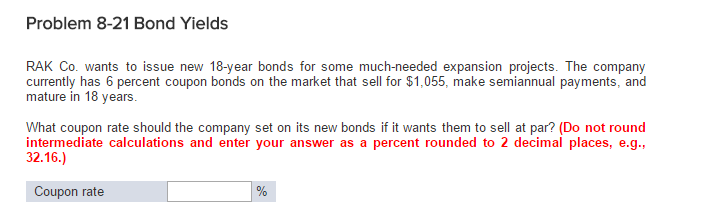

Answer in Finance for rim #9185 - Assignment Expert What coupon rate should the company set on its new bonds if it wants them to sell at par? 6.25 percent 6.37 percent 6.50 percent 6.67 percent 6.75 percent Expert's answer Coupon rate is annual payout as a percentage of the bond's par value. Compounding = semi annually Par Value = 1000 Market Rate = 6.5 Market Price = 972.78 N = 40 RAK Co. wants to issue new 20-year bonds for some...get 1 The company currently has 6 percent coupon bonds on the market that sell for $1,055, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Uliana Co. wants to issue new 20-year bonds for some much needed Need more help! Uliana Co. wants to issue new 20-year bonds for some much needed expansion projects. The company currently has 6 percent coupon bonds on the market with a par value of $1,000 that sell for $967, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? Pembroke co wants to issue new 20 year bonds for some The company should set the coupon rate on its new bonds equal to the required return; the required return can be observed in the market by finding the YTM on outstanding bonds of the company. Enter 40 $35 $1,000 N I/Y PV PMT FV Solve for 3.218% 3.218% × 2 = 6.44% Assignment Print View

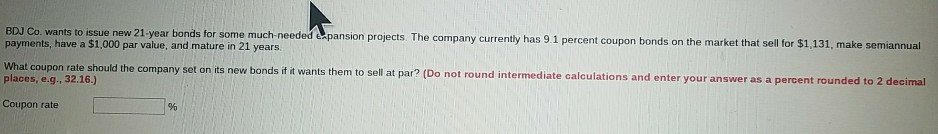

Quiz 6 PDF - 1.BDJ Co. wants to issue new 21-year bonds for... What coupon rate should the company set on its new bonds if it wants them to sell at par? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Coupon rate 7 .8 2 ± 1 .0 % % Explanation: The company should set the coupon rate on its new bonds equal to the required return of the ... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Assuming that the price of the bond increases to $1,500, then the yield-to-maturity changes from 2% to 1.33% ($20/$1,500= 1.33%). If the price of the bond falls to $800, then the yield-to-maturity will change from 2% to 2.5% ( i.e., $20/$800= 2.5%). The yield-to-maturity only equals the coupon rate when the bond sells at face value. Solved - Uliana Co. wants to issue new 20-Answer | Course Eagle Uliana Co. wants to issue new 20-year bonds for some muchneeded expansion projects. The company currently has 6 percent coupon bonds on the market with a par value of $1,000 that sell for $967, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? Chamberlain Co. wants to issue new 19-year bonds for some much-needed ... Chamberlain Co. wants to issue new 19-year bonds for some much-needed expansion projects. The company currently has 10 percent coupon bonds on the market that sell for $1,050, make semiannual payments, and mature in 19 years. What coupon rate should the company set on its new bonds if it wants them to sell at par

FIN Flashcards - Quizlet The company currently has 8.8 percent coupon bonds on the market that sell for $950.85, make semiannual payments, and mature in 16 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? Assume a par value of $1,000. ... Weismann Co. issued 19-year bonds a year ago at a coupon rate of 10 percent.

BDJ Co. wants to issue new 25-year bonds for some much ... - Brainly.com BDJ Co. wants to issue new 25-year bonds for some much-needed expansion projects. The company currently has 4.8 percent coupon bonds on the market that sell for $1,028, make semiannual payments, have a $1,000 par value, and mature in 25 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? Advertisement

Solved Uliana Company wants to issue new 21-year bonds for | Chegg.com The company currently has 9.6 percent coupon bonds on the market that sell for $1,136, make semiannual payments, have a par value of $1,000, and mature in 21 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? Expert Answer At 8% Vo = 96/2× [1- (1.04)^-42/0.04] + 1000 (1.04)^-42 … View the full answer

Finance Midterm 1 Flashcards | Quizlet LKM, Inc. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 6.5 percent coupon bonds on the market that sell for $972.78, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par?

Bond Yields RAK Co. wants to issue new 20-year bonds for... ask 5 Bond Yields RAK Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 5.7 percent coupon bonds on the market that sell for $1,048, have a par value of $1,000, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par?

Solved Uliana Company wants to issue new 15-year bonds for - Chegg The company currently has 9 percent coupon bonds on the market that sell for $1,070, make semiannual payments, and mature in 15 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)

Seether co wants to issue new 20 year bonds for some - Course Hero Seether Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 8 percent coupon bonds on the market that sell for $930, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? →8.75%.

Business Finance Ch6 Quiz - Connect Flashcards | Quizlet Coupon payment = (1000 x 7.9%x50%) Coupon payment = 39.5 Number of periods = 13 x 2 Number of periods = 26 Periodic YTM = 5.6%/2 Periodic YTM = 2.8% Price = -PV (rate,nper,pmt,fv)) Price = -PV (2.8%,26,39.5,1000) Price = 1,210.40 You purchase a bond with an invoice price of $1,145.

![Solved: Problem 7-22 Bond Yields [L02] Chamberlain Co. Wan... | Chegg.com](https://media.cheggcdn.com/media/6ef/6efb46da-a5bf-419b-967b-060dd93a9d97/phphA3jaf.png)

Post a Comment for "44 what coupon rate should the company set on its new bonds if it wants them to sell at par"