44 yield to maturity coupon bond

Yield to Maturity (YTM): What It Is, Why It Matters, Formula A bond's yield to maturity (YTM) is the internal rate of return required for the present value of all the future cash flows of the bond (face value and coupon ... How to Calculate Yield to Maturity (YTM) - Wall Street Prep From the perspective of a bond investor, the yield to maturity (YTM) is the anticipated total return received if the bond is held to its maturity date and all ...

Understanding Bond Yield and Return | FINRA.org Aug 11, 2022 ... Yield to maturity (YTM) is the overall interest rate earned by an investor who buys a bond at the market price and holds it until maturity.

Yield to maturity coupon bond

Yield to Maturity - NYU Stern Therefore, zero rates imply coupon bonds yields and coupon bond yields imply zero yields. Page 5. Debt Instruments and Markets. Professor Carpenter. Yield to ... Yield to Maturity (YTM) - Definition, Formula, Calculation Examples The current yield of bond= Annual coupon payment/current market priceread more, which measures the present value of the bond, the yield to maturity measures the ... Yield to maturity - Fixed income - Robeco The yield to maturity (YTM) of a bond is the annualized return that a bond investor would receive from holding the bond until maturity.

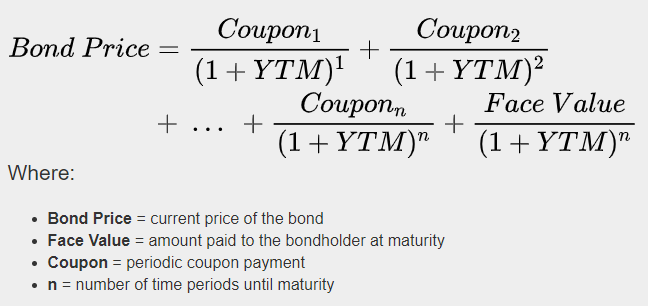

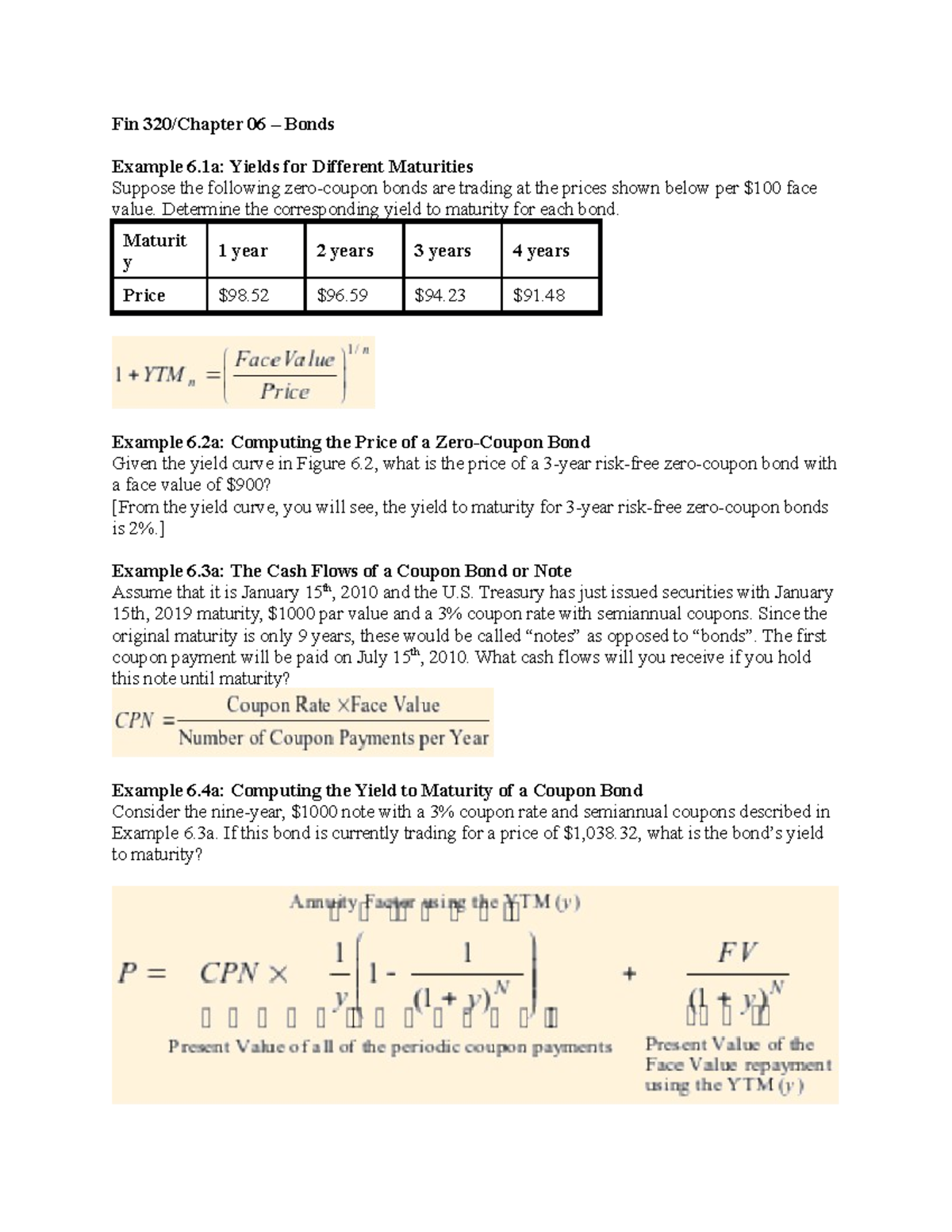

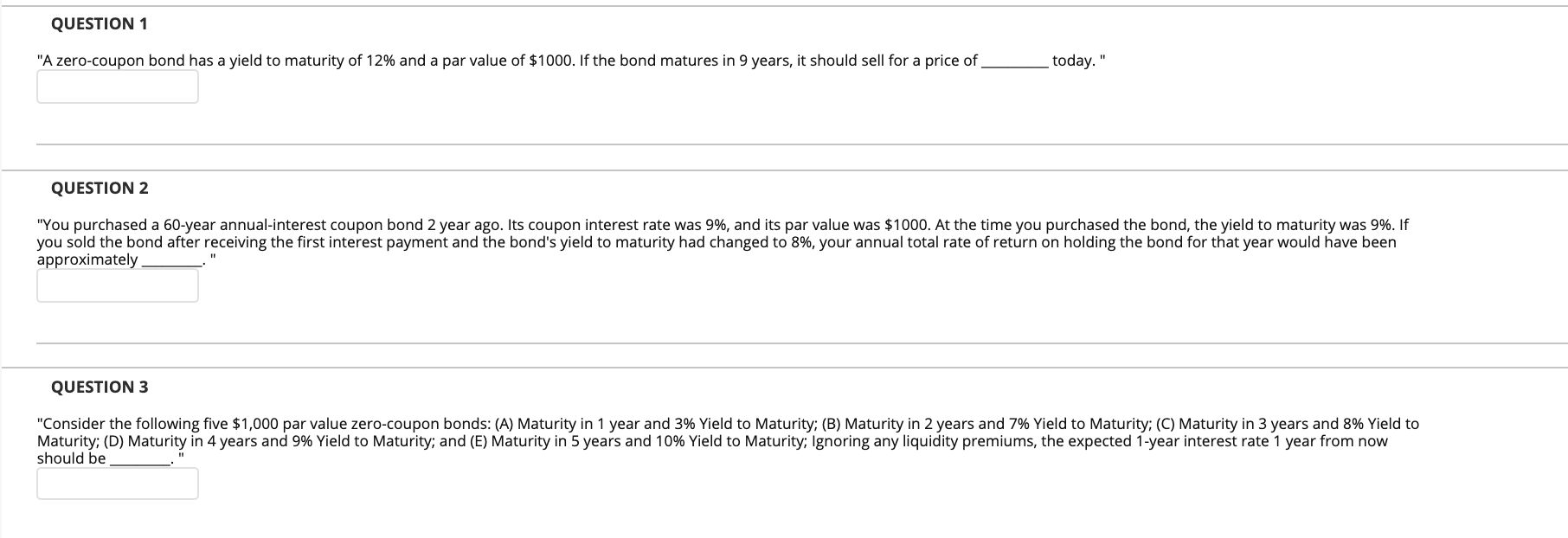

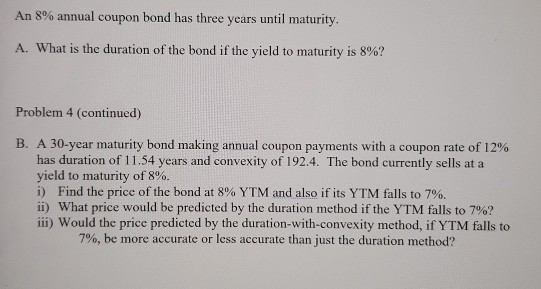

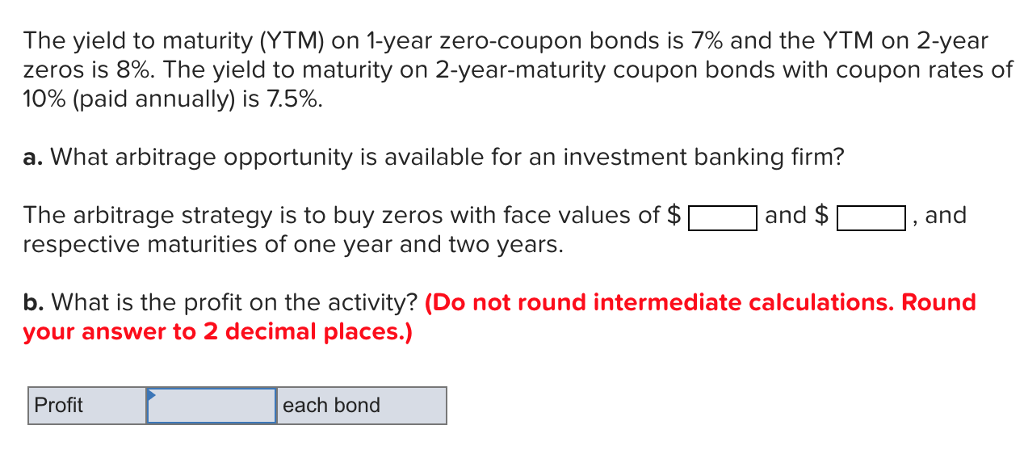

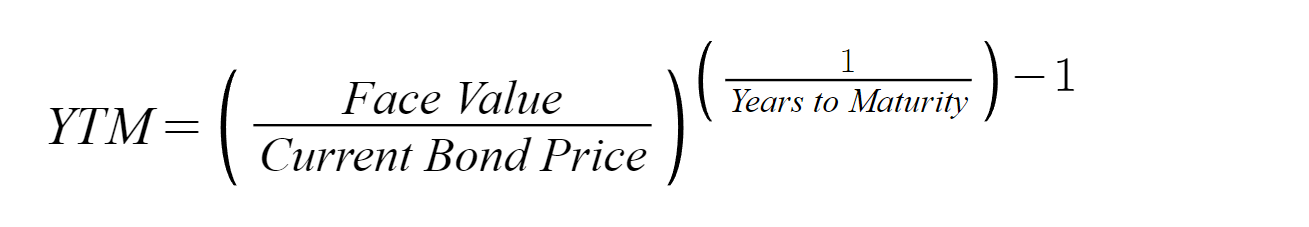

Yield to maturity coupon bond. Interest Rates and Bond Valuation Consider a bond with a coupon rate of 10% and annual coupons. The par value is $1,000, and the bond has 5 years to maturity. The yield to maturity is 11%. Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. · The coupon rate is ... Yield to Maturity – What it is, Use, & Formula - Speck & Company There are two formulas for yield to maturity depending on the bond. The yield to maturity formula for a zero-coupon bond: Yield to maturity = [(Face Value / ... Yield to Maturity (YTM) - Overview, Formula, and Importance May 7, 2022 ... The YTM is based on the belief or understanding that an investor purchases the security at the current market price and holds it until the ...

Yield to maturity - Fixed income - Robeco The yield to maturity (YTM) of a bond is the annualized return that a bond investor would receive from holding the bond until maturity. Yield to Maturity (YTM) - Definition, Formula, Calculation Examples The current yield of bond= Annual coupon payment/current market priceread more, which measures the present value of the bond, the yield to maturity measures the ... Yield to Maturity - NYU Stern Therefore, zero rates imply coupon bonds yields and coupon bond yields imply zero yields. Page 5. Debt Instruments and Markets. Professor Carpenter. Yield to ...

Consider a coupon bond that has a 900 par value and a coupon rate of 6 %. The bond is currently selling for 860.15 and has two years to maturity. What is the bond's yield to maturity (YTM)?

Post a Comment for "44 yield to maturity coupon bond"