44 formula for coupon rate

Discount Rate Formula | How to calculate Discount Rate with ... Discount Rate = ($3,000 / $2,200) 1/5 – 1 Discount Rate = 6.40% Therefore, in this case the discount rate used for present value computation is 6.40%. Discount Rate Formula – Example #2 Effective Interest Rate Formula | Calculator (With Excel ... Effective Interest Rate = (1 + 10%/2) 2 – 1 Effective Interest Rate = 10.25% Therefore, the effective interest rate for the quoted investment is 10.25%. Effective Interest Rate Formula– Example #2

Black–Scholes model - Wikipedia In practice, interest rates are not constant—they vary by tenor (coupon frequency), giving an interest rate curve which may be interpolated to pick an appropriate rate to use in the Black–Scholes formula. Another consideration is that interest rates vary over time.

Formula for coupon rate

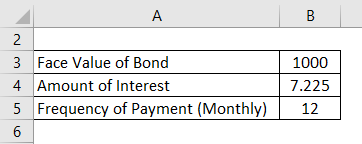

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate Formula helps in calculating and comparing the coupon rate of differently fixed income securities and helps to choose the best as per the requirement of an investor. It also helps in assessing the cycle of interest rate and expected market value of a bond, for eg. Daily Compound Interest Formula | Examples with Excel Template Daily Compound Interest = $610.51 So you can see that in daily compounding, the interest earned is more than in annual compounding. Example #2. Let’s say you have $10,000 from a lottery and want to invest that to earn more income. Current Yield Formula | Calculator (Examples with Excel Template) Step 1: Firstly, determine the annual cash flow to be generated by the bond based on its coupon rate, par value, and frequency of payment. Step 2: Next, determine the current market price of the bond based on its own coupon rate vis-à-vis the ongoing yield offered by other bonds in the market. Based on the fact that whether its coupon rate is ...

Formula for coupon rate. Simple Interest Rate Formula | Calculator (Excel template) Simple Interest Rate Formula – Example #3. DHFL Ltd issued a coupon-bearing bond of Rs.100000 which carries an interest rate of 7% p.a. the bond has a useful life of 15 months, after which the bond will be redeemed. Interest earned by the investor can be calculated as follows: Current Yield Formula | Calculator (Examples with Excel Template) Step 1: Firstly, determine the annual cash flow to be generated by the bond based on its coupon rate, par value, and frequency of payment. Step 2: Next, determine the current market price of the bond based on its own coupon rate vis-à-vis the ongoing yield offered by other bonds in the market. Based on the fact that whether its coupon rate is ... Daily Compound Interest Formula | Examples with Excel Template Daily Compound Interest = $610.51 So you can see that in daily compounding, the interest earned is more than in annual compounding. Example #2. Let’s say you have $10,000 from a lottery and want to invest that to earn more income. Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate Formula helps in calculating and comparing the coupon rate of differently fixed income securities and helps to choose the best as per the requirement of an investor. It also helps in assessing the cycle of interest rate and expected market value of a bond, for eg.

:max_bytes(150000):strip_icc()/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "44 formula for coupon rate"