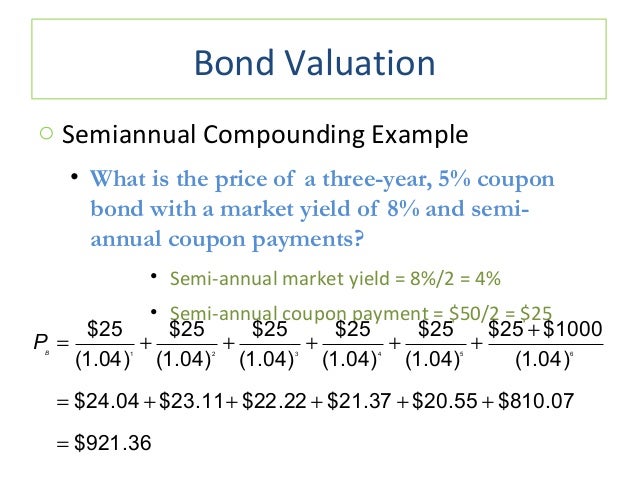

44 present value of coupon bond

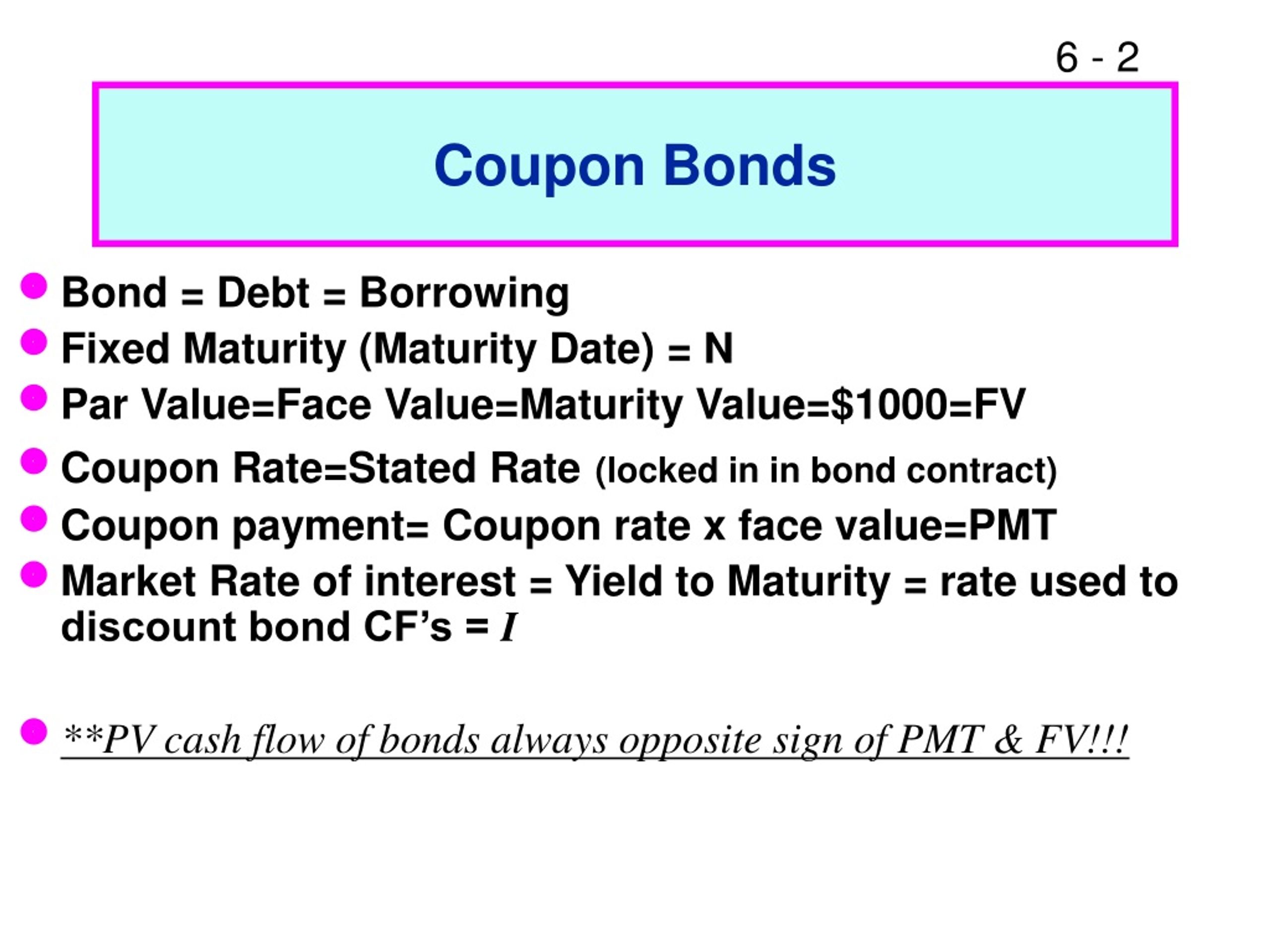

Bond Price Calculator – Present Value of Future Cashflows - DQYDJ The bond pricing calculator shows the price of a bond from coupon rate, market rate, and present value of payouts. Plus dirty & clean bond price formulas. Bond Present Value Calculator Bond Present Value Calculator. Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity.

Present Value Formula | Calculator (Examples with Excel Template) Present Value= $961.54 + $924.56 + $889.00 + $854.80; Present Value = Therefore, the present-day value of John’s lottery winning is . Explanation. The formula for the present value can be derived by using the following steps: Step 1: Firstly, figure out the future cash flow which is denoted by CF. Step 2: Next, decide the discounting rate ...

Present value of coupon bond

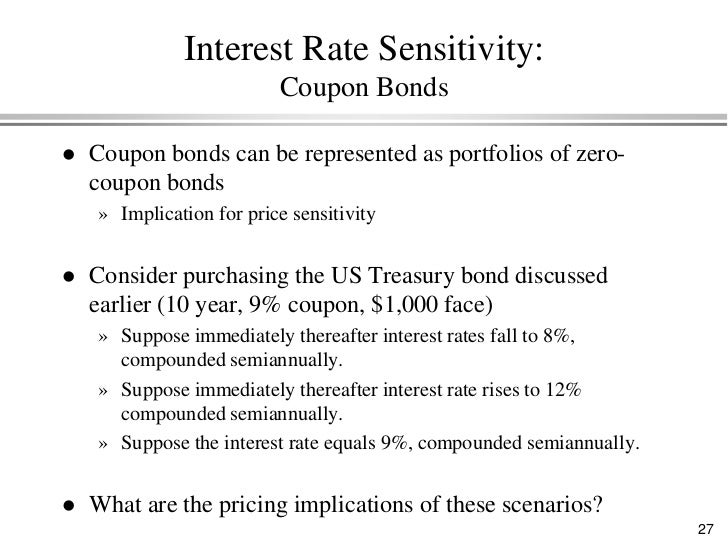

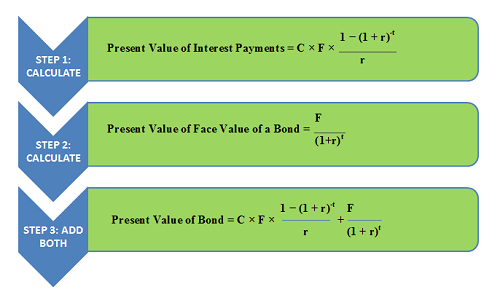

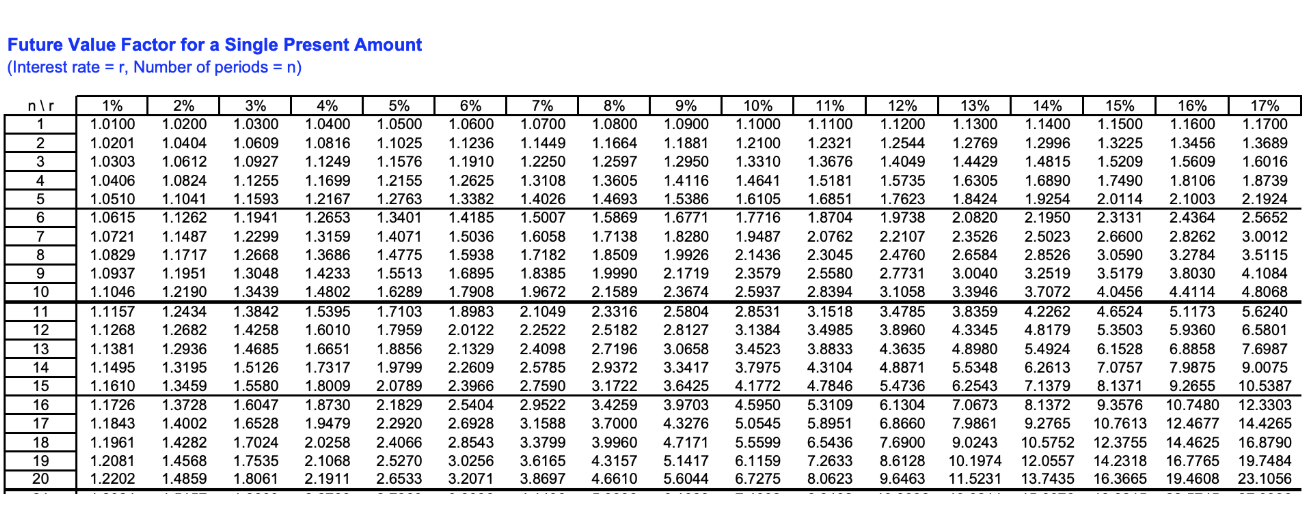

Present Value Calculator - Moneychimp Present Value Formula. Present value is compound interest in reverse: finding the amount you would need to invest today in order to have a specified balance in the future. Among other places, it's used in the theory of stock valuation. See How Finance Works for the present value formula. You can also sometimes estimate present value with The ... What Is Present Value (PV)? - Investopedia Jun 13, 2022 · Present Value - PV: Present value (PV) is the current worth of a future sum of money or stream of cash flows given a specified rate of return . Future cash flows are discounted at the discount ... Calculating the Present Value of a 9% Bond in an 8% Market Recall that the present value of a bond consisted of: The present value of a bond's interest payments, PLUS; The present value of a bond's maturity amount. The present value of the bond in our example is $36,500 + $67,600 = $104,100. The bond's total present value of $104,100 should approximate the bond's market value.

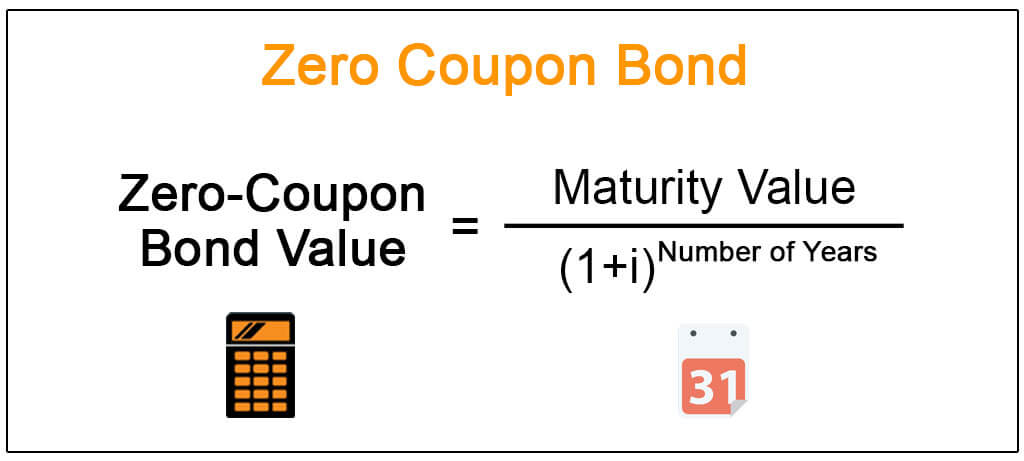

Present value of coupon bond. How to Calculate Present Value of a Bond - Pediaa.Com Sep 02, 2014 · C = Coupon rate of the bond F = Face value of the bond R = Market t = Number of time periods occurring until the maturity of the bond. Step 2: Calculate Present Value of the Face Value of the Bond. This refers to the maturity value of the bond, which can be calculated using the following formula. Step 3: Calculate Present Value of Bond Calculating the Present Value of a 9% Bond in an 8% Market Recall that the present value of a bond consisted of: The present value of a bond's interest payments, PLUS; The present value of a bond's maturity amount. The present value of the bond in our example is $36,500 + $67,600 = $104,100. The bond's total present value of $104,100 should approximate the bond's market value. What Is Present Value (PV)? - Investopedia Jun 13, 2022 · Present Value - PV: Present value (PV) is the current worth of a future sum of money or stream of cash flows given a specified rate of return . Future cash flows are discounted at the discount ... Present Value Calculator - Moneychimp Present Value Formula. Present value is compound interest in reverse: finding the amount you would need to invest today in order to have a specified balance in the future. Among other places, it's used in the theory of stock valuation. See How Finance Works for the present value formula. You can also sometimes estimate present value with The ...

Post a Comment for "44 present value of coupon bond"