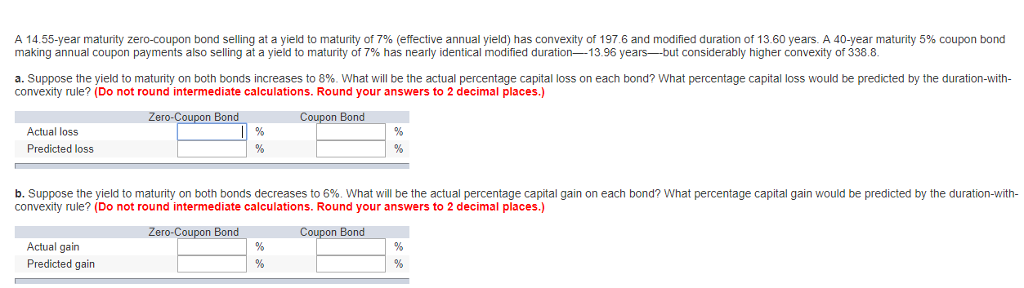

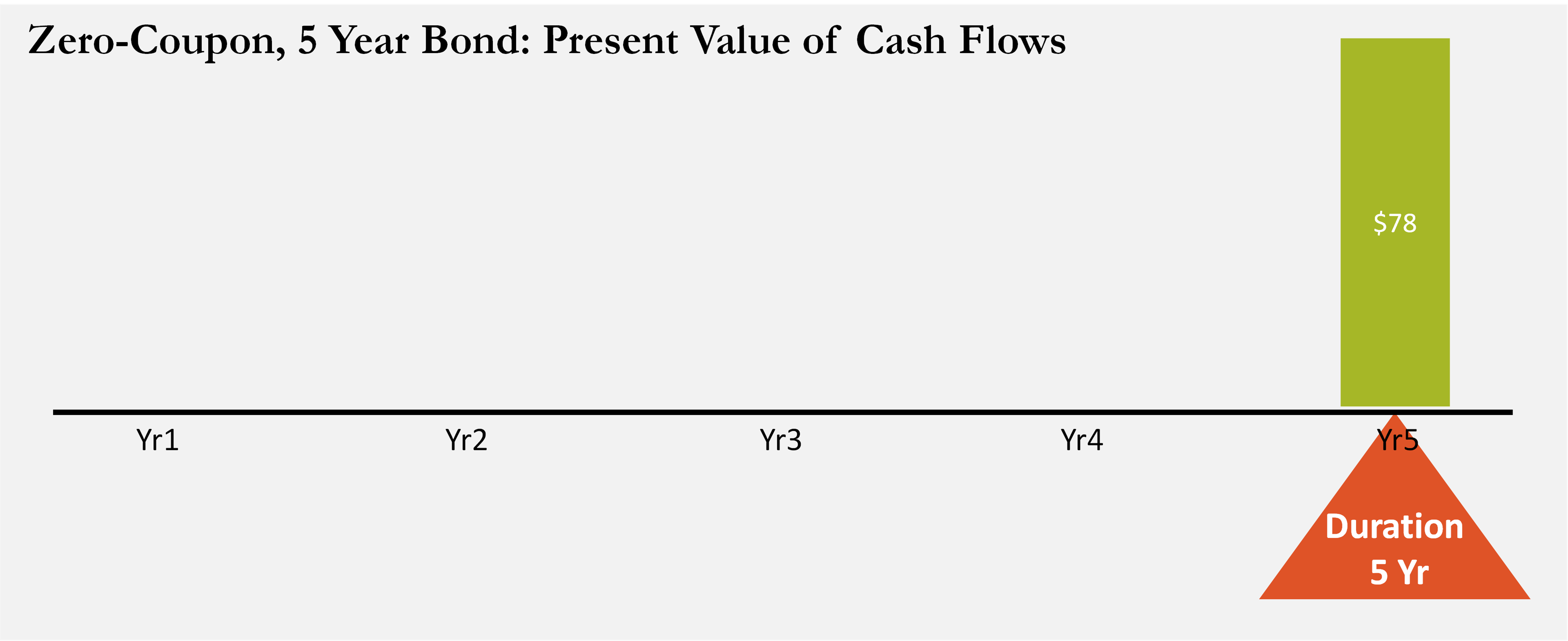

45 duration for zero coupon bond

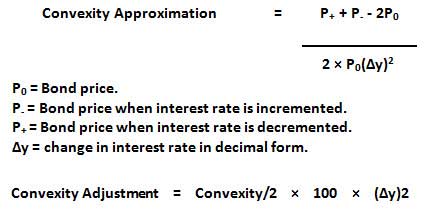

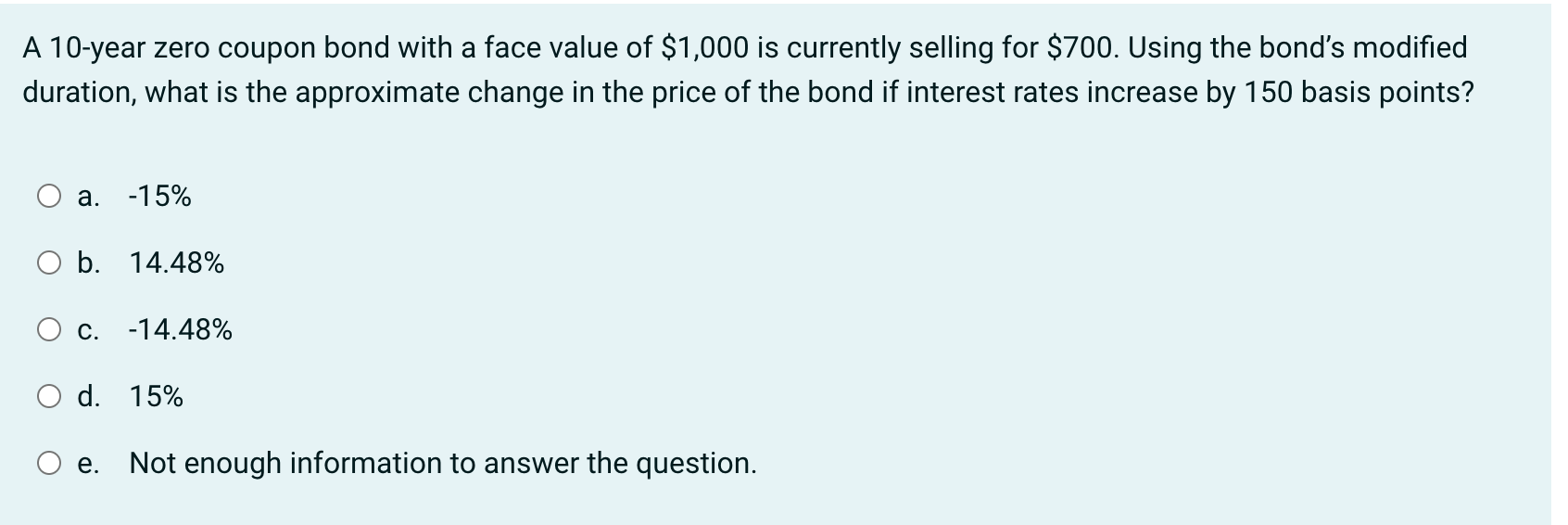

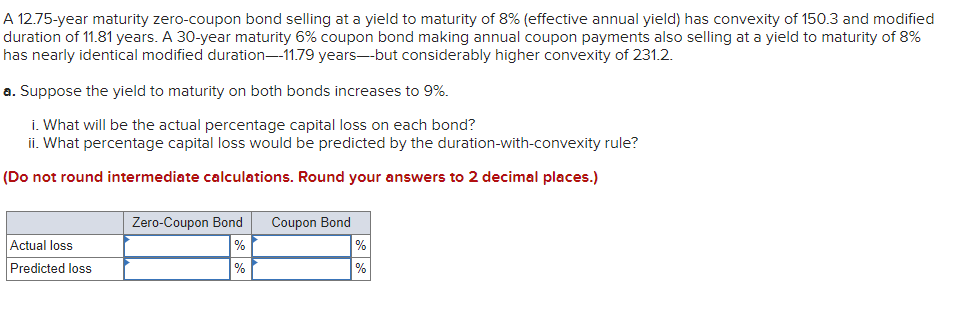

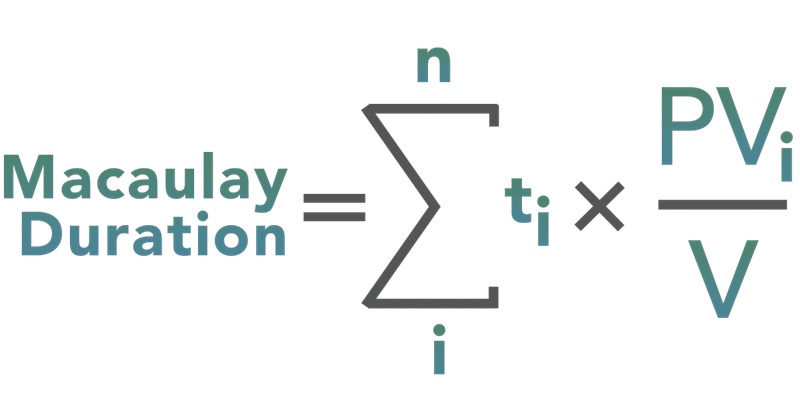

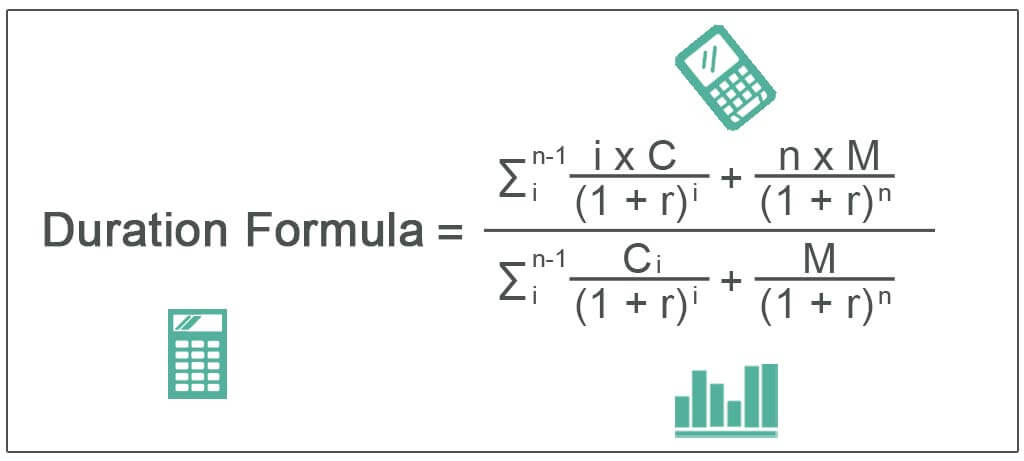

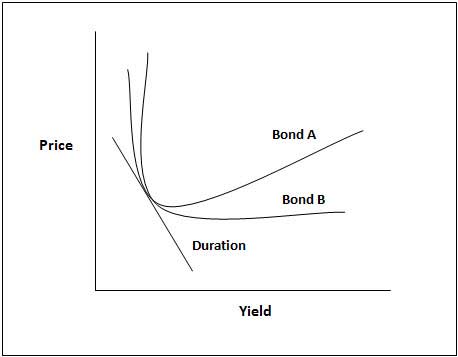

Convexity of a Bond | Formula | Duration | Calculation - WallStreetMojo The duration of the zero-coupon bond which is equal to its maturity (as there is only one cash flow) and hence its convexity is very high; While the duration of the zero-coupon bond Zero-coupon Bond In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a ... PDF Understanding Duration - BlackRock rates, duration allows for the effective comparison of bonds with different maturities and coupon rates. For example, a 5-year zero coupon bond may be more sensitive to interest rate changes than a 7-year bond with a 6% coupon. By comparing the bonds' durations, you may be able to anticipate the degree of

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000.

Duration for zero coupon bond

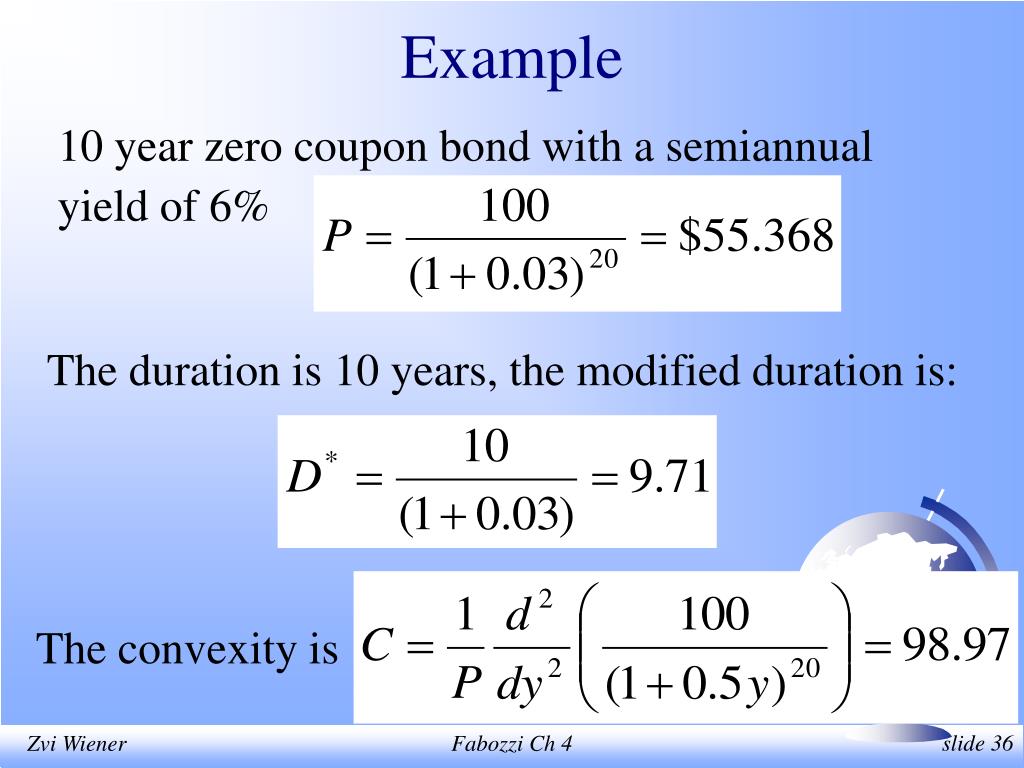

What are Zero-Coupon Bonds? (Characteristics + Calculator) If the zero-coupon bond compounds semi-annually, the number of years until maturity must be multiplied by two to arrive at the total number of compounding periods (t). Formula Price of Bond (PV) = FV / (1 + r) ^ t Where: PV = Present Value FV = Future Value r = Yield-to-Maturity (YTM) t = Number of Compounding Periods Duration and Zero Coupon Bonds - YouTube Examples of Macaulay duration are given for zero coupon bonds. How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping n = 10 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 10%) 10 Zero coupon bond price = 508.35 (rounded to 508) In this example the bondholder has to wait 10 years before they receive the face value of the bond.

Duration for zero coupon bond. Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. Zero Coupon Bond | Investor.gov The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a long-range goal, such as paying for a child's college education. With the deep discount, an investor can put up a small amount of money that can grow over many years. What is the duration of a zero coupon bond? - Quora Originally Answered: what is the duration of a zero coupon bond? Zero coupon bond can be of any duration , can be from one year to 10 years. It is ordinarily from 3 to 5 years. Zero coupon bonds are issued at a discount with par value paid on redemption, sometimes with a nominal premium. Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

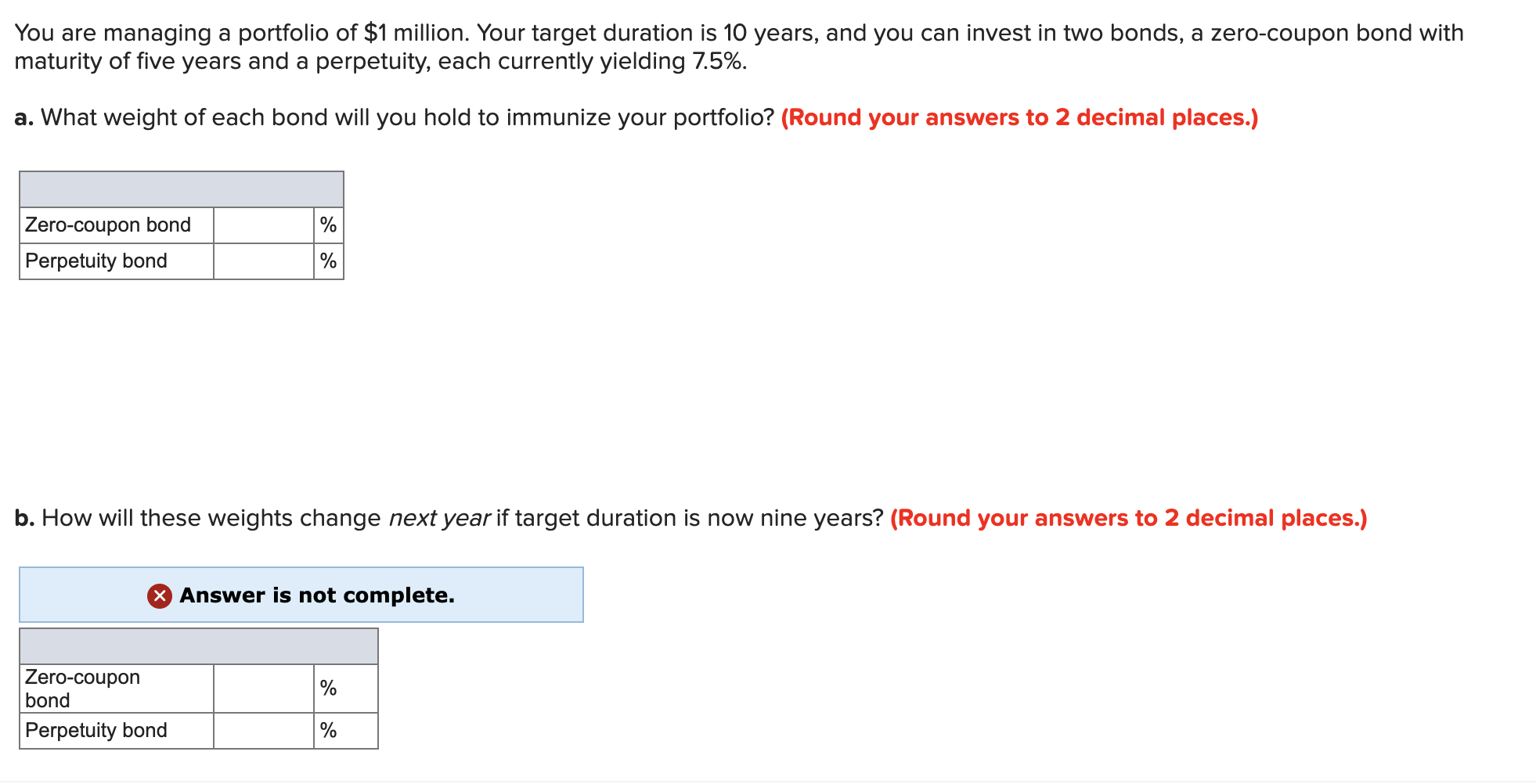

Zero Coupon Bond -Features, benefits, drawbacks, taxability ... - Fisdom Duration in a zero-coupon bond is the time to maturity. Normally, these bonds come with a duration of 10 years or more. How to invest in zero coupon bonds? Zero coupon bonds are issued periodically by governments and pseudo-government institutions. Once these bonds are issued, they can be bought through stock exchanges such as NSE and BSE. What is the period of a zero coupon bond? | Personal Accounting The bond issuer pays interest to the bondholders for the duration of the bond's time period. Bonds are loan agreements involving creditors and borrowers. When Convertible Bonds Become Stock. ... Zero coupon bonds have a period equal to the bond's time to maturity, which makes them sensitive to any modifications within the rates of interest. ... Duration: Understanding the Relationship Between Bond Prices and ... In the case of a zero-coupon bond, the bond's remaining time to its maturity date is equal to its duration. When a coupon is added to the bond, however, the bond's duration number will always be less than the maturity date. The larger the coupon, the shorter the duration number becomes. Generally, bonds with long maturities and low coupons have ... Bond - BUSN 426 2022 Bb (1).xlsx - Three Bond Duration Examples Coupon ... Zero coupon bond duration = 5 Perpetual bond duration = 11 Intended holding period = 8 Total investment = 1,000,000 Let X represent the weighted invested in zero coupon bond; (1-x) is the weighed invested in perpetual bond X = 0.5 <--- weighted average invested in zero coupon bonds 1 ...

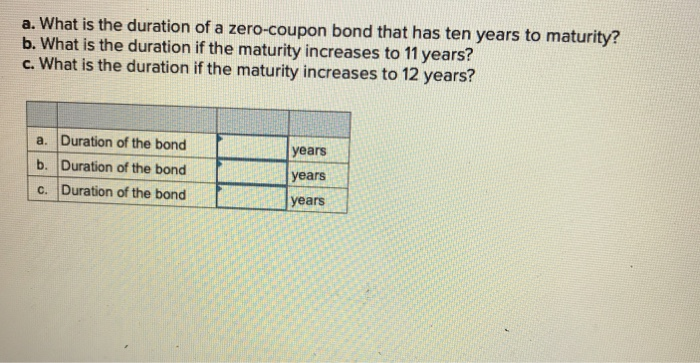

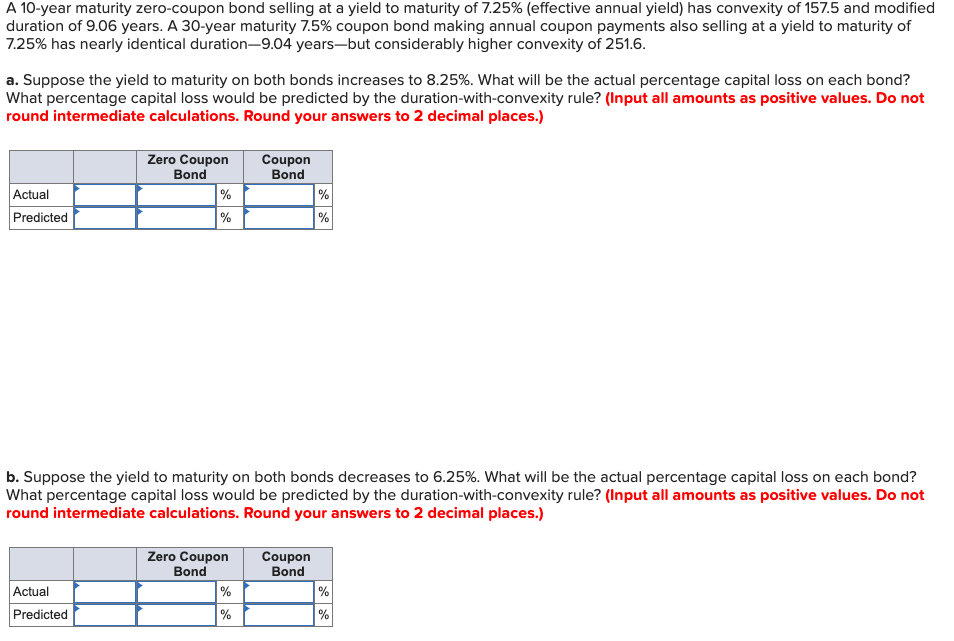

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months. Zero-Coupon Bond - Definition, How It Works, Formula Interest rate risk is relevant when an investor decides to sell a bond before maturity and affects all types of fixed-income investments. For example, recall that John paid $783.53 for a zero-coupon bond with a face value of $1,000, 5 years to maturity, and a 5% interest rate compounded annually. What is the duration of a zero-coupon bond that has eight years ... - Quora The duration of a zero-coupon bond is by definition equal to its maturity, so an 8-year zero has a duration of 8 years. If the maturity increases to 10 years, then so does the duration. 1 Kyle Taylor Founder at The Penny Hoarder (2010-present) Updated Wed Promoted Should you leave more than $1,000 in a checking account? You've done it. Zero Coupon Bond Calculator - Nerd Counter Macaulay Duration Formula = 1PV∑Tt=1 (t×PVt) If there is no coupon bond, we can also calculate the duration by using the formula mentioned under: Macaulay Duration = 1PV (T×PVT). PV = PVT = Face Value (1+r) T Therefore: Macaulay Duration = 1PV (T×PV) = T Here: D = Macaulay duration of the bond T = Periods up to the maturity i = the ith time period

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping n = 10 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 10%) 10 Zero coupon bond price = 508.35 (rounded to 508) In this example the bondholder has to wait 10 years before they receive the face value of the bond.

Duration and Zero Coupon Bonds - YouTube Examples of Macaulay duration are given for zero coupon bonds.

What are Zero-Coupon Bonds? (Characteristics + Calculator) If the zero-coupon bond compounds semi-annually, the number of years until maturity must be multiplied by two to arrive at the total number of compounding periods (t). Formula Price of Bond (PV) = FV / (1 + r) ^ t Where: PV = Present Value FV = Future Value r = Yield-to-Maturity (YTM) t = Number of Compounding Periods

:max_bytes(150000):strip_icc()/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "45 duration for zero coupon bond"