38 zero coupon bond face value

What Is a Zero-Coupon Bond? | The Motley Fool Zero-coupon bonds compensate for not paying any interest over the life of the bond by being available for far less than face value. Put another way, without a deep discount, zero-coupon bonds ... Images 26 Oct 2022 — Pricing Zero-Coupon Bonds ; Face value is the future value (maturity value) of the bond; ; r is the required rate of return or interest rate; and ...

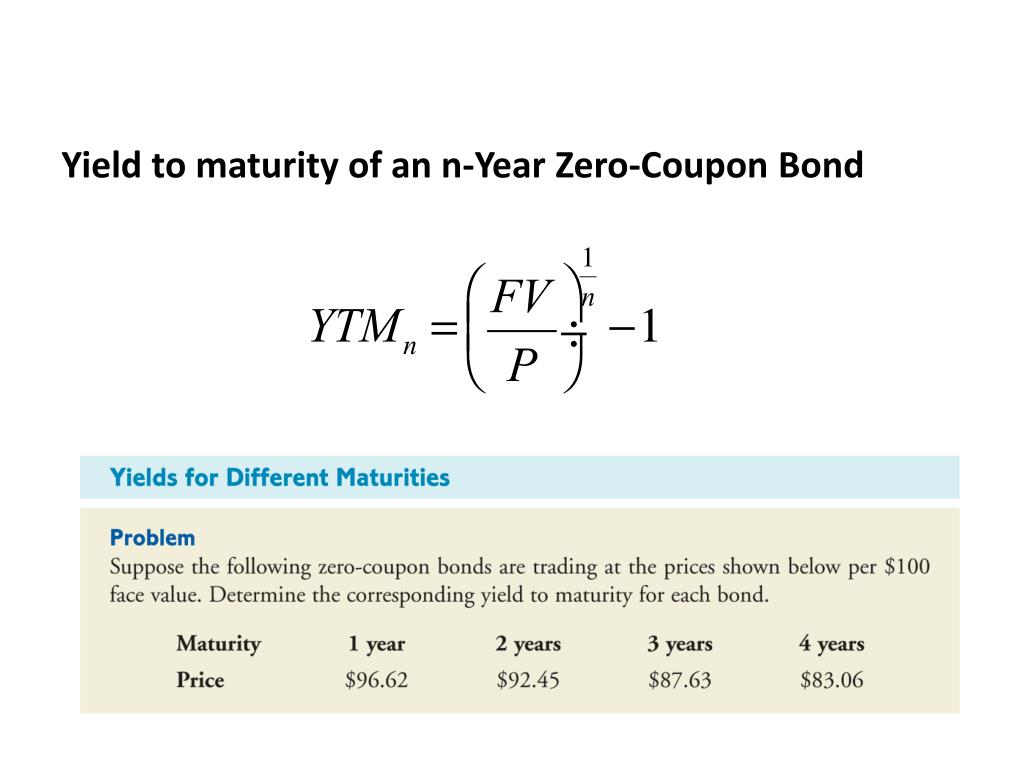

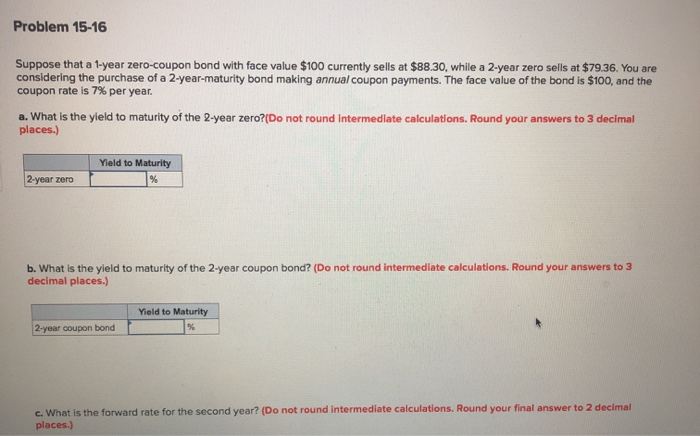

Zero Coupon Bond Value Calculator: Calculate Price, Yield to ... The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bond's term. Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. 20. Calculating Yield to Maturity on a Zero-coupon Bond

Zero coupon bond face value

What Is a Zero-Coupon Bond? Definition, Advantages, Risks For example, a zero-coupon bond with a face value of $20,000 that matures in 20 years with an interest rate of 5.5% might sell for around $7,000. At maturity, two decades later, the... Answered: A zero coupon bond with a face value of… | bartleby The bonds have a face value of 1,000 and an 8% coupon rate, paid semiannually. The price of the bonds is 1,100. The bonds are callable in 5 years at a call price of 1,050. Zero Coupon Bond Calculator - Nerd Counter In the given formula, the numeral of zero (0) represents that there is no coupon yet. Face Value (F) Rate/Yield (r) Time to Maturity (t) = When the term zero-coupon bond comes, the two words urgently come into mind; one is the pure discount bond, and the other one is the discount bond. Both of these words represent the common zero coupon bond term.

Zero coupon bond face value. Zero Coupon Bond | Investor.gov Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. Solved Find the face value of the zero-coupon bond. 15-year | Chegg.com Transcribed image text: Find the face value of the zero-coupon bond. 15-year bond at 3.3%; price $3000 The face value will be $. (Do not round until the final answer. Then round to the nearest dollar as needed.) A six-month $4800 treasury bill sold for $4562. What was the simple annual discount rate? The discount rate was %. Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. [1] Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par (or face) value. Zero Coupon Bond Definition and Example | Investing Answers Let's say you wanted to purchase a zero-coupon bond that has a $1,000 face value, with a maturity date three years from now. You've determined you want to earn 5% per year on the investment. Using the formula above you might be willing to pay: $1,000 / (1+0.025)^6 = $862.30

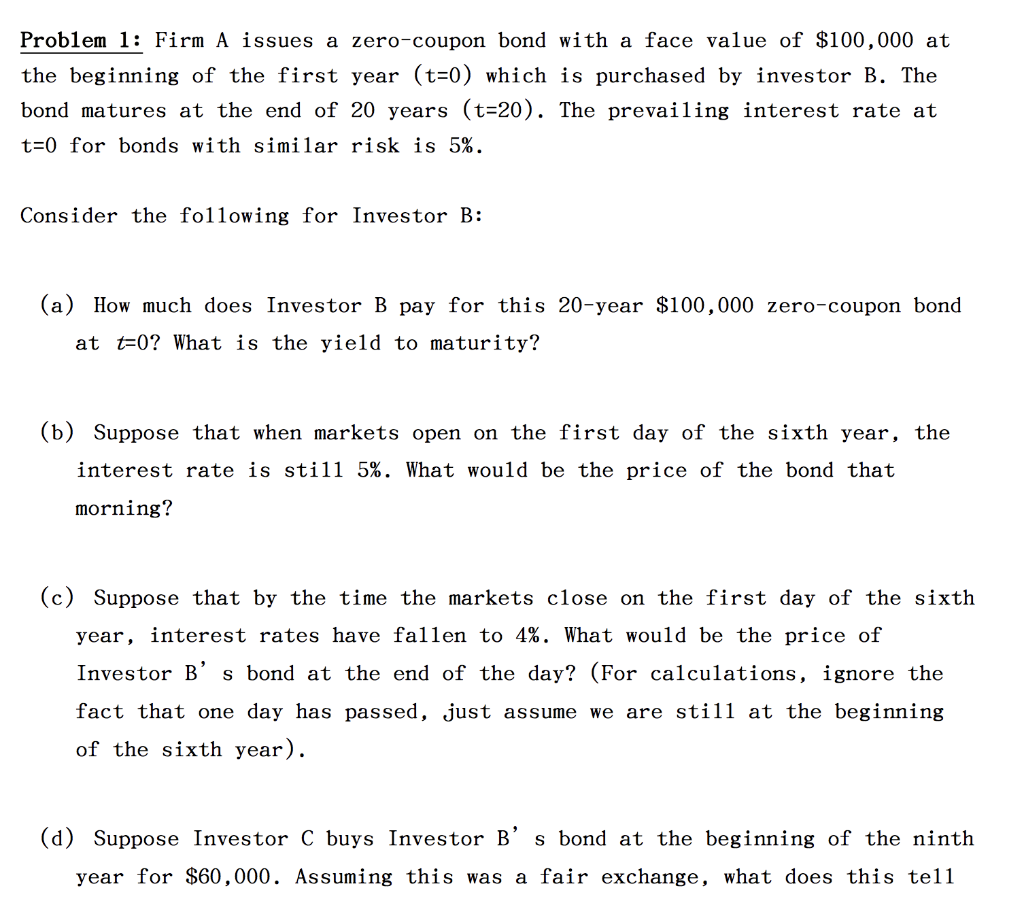

Zero Coupon Bond Calculator – What is the Market Value? The zero coupon bond price formula is: \frac {P} { (1+r)^t} (1+ r)tP where: P: The par or face value of the zero coupon bond r: The interest rate of the bond t: The time to maturity of the bond Zero Coupon Bond Pricing Example Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000 Bond (finance) - Wikipedia The bond's market price is usually expressed as a percentage of nominal value: 100% of face value, "at par", corresponds to a price of 100; prices can be above par (bond is priced at greater than 100), which is called trading at a premium, or below par (bond is priced at less than 100), which is called trading at a discount. Zero Coupon Bond Value - Formula (with Calculator) After 5 years, the bond could then be redeemed for the $100 face value. Example of Zero Coupon Bond Formula with Rate Changes. A 6 year bond was originally issued one year ago with a face value of $100 and a rate of 6%. As the prior example shows, the value at the 6% rate with 5 years remaining would be $74.73. Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

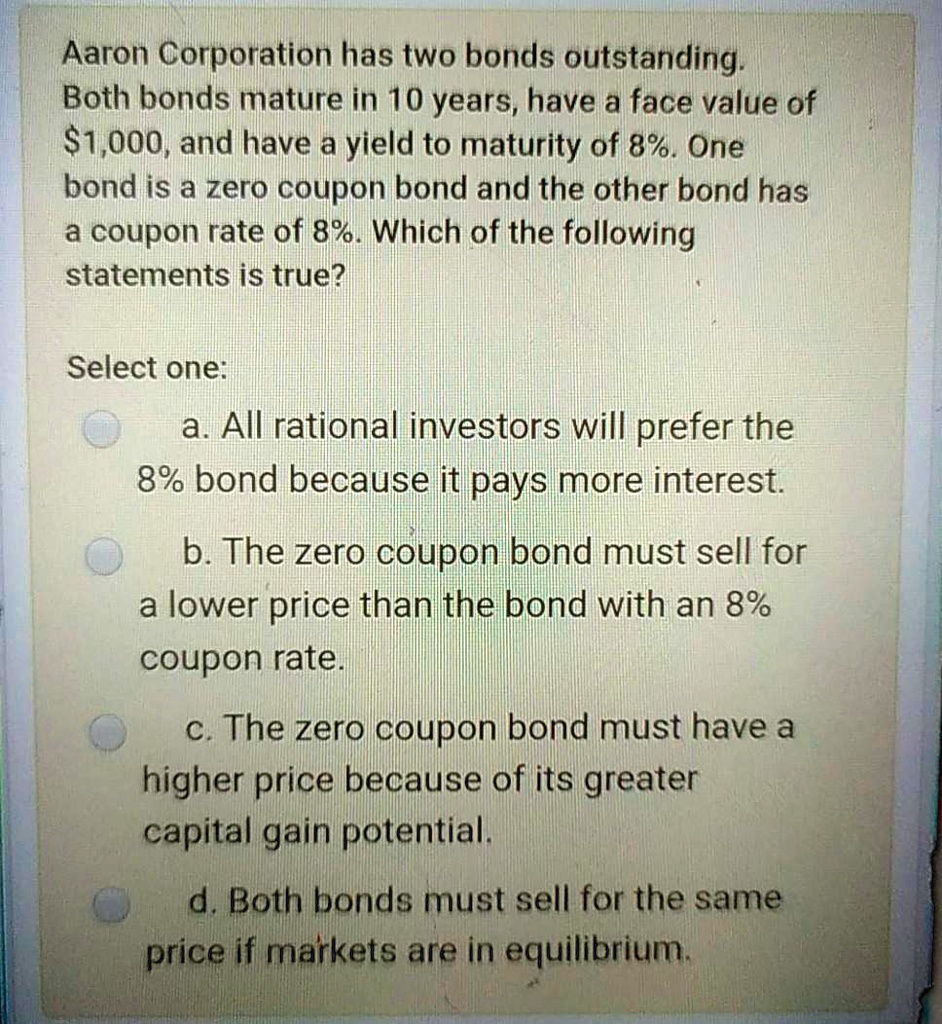

What are Zero-coupon Bonds? Price of the zero coupon bond = Face Value/1/(1+r/2) ^(2n) If the maturity value of the bond is Rs 25,000 and the interest rate is 6% P.A., and the period is 3 years, our purchase price of the zero coupon bond would be Rs 20,991 using the above formula. This is calculated as below: The price of the zero coupon bond = 25000 / (1+.06) ^ (3) = Rs ... Zero Coupon Bond - Explained - The Business Professor, LLC 17 Apr 2022 — The trading value goes up as the bond approaches its priority date. The priority date is the date on which the bonds face value will be payable. Zero Coupon Bond | Definition, Formula & Examples Based on the calculated present value of the coupon rate and the present value of the face value, the total price of the coupon bond is $47.84 + $942.60 = $990.44 Zero-Coupon Bond vs Coupon Bond: Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Well, for one thing, zero-coupon bonds are bought for a fraction of face value. For example, a $20,000 bond can be purchased for far less than half of that amount. Then there are the...

1. Consider a zero-coupon bond with a $1,000 face value and 15... Answered step-by-step. 1. Consider a zero-coupon bond with a $1,000 face value and 15... 1. Consider a zero-coupon bond with a $1,000 face value and 15 years to maturity. The price will this bond trade if the YTM is 7.3 % is closest to: 2. What is the yield to maturity of a one-year, risk-free, zero-coupon bond with a $10,000 face value and a ...

The One-Minute Guide to Zero Coupon Bonds | FINRA.org For example, you might pay $3,500 to purchase a 20-year zero coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000. For this reason, zero coupon bonds are often purchased to meet a future expense such as college costs or an anticipated expenditure in retirement.

Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas The zero coupon bond effective yield formula is used to calculate the periodic return for a zero coupon bond, or sometimes referred to as a discount bond. A zero coupon bond is a bond that does not pay dividends (coupons) per period, but instead is sold at a discount from the face value. For example, an investor purchases one of these bonds at ...

Value and Yield of a Zero-Coupon Bond | Formula & Example - XPLAIND.com The forecasted yield on the bonds as at 31 December 20X3 is 6.8%. Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value of Total Holding = 100 × $553.17 = $55,317 Expected accrued income = Value at the end of a period − Value at the start of a period

Zero Coupon Bond Calculator - MiniWebtool When the bond reaches maturity, its investor receives its face value. It is also called a discount bond or deep discount bond. Formula The zero-coupon bond value calculation formula is as follows: Zero coupon bond value = F / (1 + r) t Where: F = face value of bond r = rate or yield t = time to maturity

Zero-Coupon Bond - Wall Street Prep To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Interest Rate Risks and "Phantom Income" Taxes

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

What Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Solved 1. a.) A zero-coupon bond has a face value of $120.00 - Chegg A zero-coupon bond has a face value of $120.00 and matures in 3 years. The rate of return on equally risky assets is 5% (.05). What will its price be today? Suppose you sell it next year when the rate of return on equally risky assets is 4% (.04). What rate of return did you earn holding the asset for a year? b.) A stock is expected to pay an ...

Traditional Zero Coupon Bonds Explained - BondsIndia A traditional zero coupon bond is a debt security that doesn't make periodic interest payments but is sold at a deep discount from its face value. The investor pays one lump sum for the bond and receives the face value of the bond when it "matures" or comes due. For example, let's say you purchase a $1,000 zero coupon bond with 20 years ...

14.3 Accounting for Zero-Coupon Bonds - Financial Accounting Because zero-coupon bonds are widely issued, some form of interest must be included. These bonds are sold at a discount below face value with the difference serving as interest. If a bond is issued for $37,000 and the company eventually repays the face value of $40,000, the additional $3,000 is interest on the debt.

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is Price = M / (1+r)n where: M = maturity value or face value of the bond r = rate of interest required n = number of years to maturity 3.

How to Calculate a Zero Coupon Bond Price | Double Entry ... Jul 16, 2019 · Using the example above, if the issue was a 10 year zero coupon bond, then the price at issue would be given as follows: n = 10 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 10%) 10 Zero coupon bond price = 508.35 (rounded to 508)

You purchased a zero coupon bond with a 1000 face value with 6 years ... Boston University. ChiefFogOpossum19. 12/02/2022. 31. You purchased a zero-coupon bond with a $1000 face value with 6 years left until maturity at a 7.6% (EAR) yield to maturity. When you sell it exactly one year later, it has a 7% (EAR) yield to maturity.

Zero Coupon Bond Calculator - Nerd Counter In the given formula, the numeral of zero (0) represents that there is no coupon yet. Face Value (F) Rate/Yield (r) Time to Maturity (t) = When the term zero-coupon bond comes, the two words urgently come into mind; one is the pure discount bond, and the other one is the discount bond. Both of these words represent the common zero coupon bond term.

Answered: A zero coupon bond with a face value of… | bartleby The bonds have a face value of 1,000 and an 8% coupon rate, paid semiannually. The price of the bonds is 1,100. The bonds are callable in 5 years at a call price of 1,050.

What Is a Zero-Coupon Bond? Definition, Advantages, Risks For example, a zero-coupon bond with a face value of $20,000 that matures in 20 years with an interest rate of 5.5% might sell for around $7,000. At maturity, two decades later, the...

Post a Comment for "38 zero coupon bond face value"