45 calculate coupon rate in excel

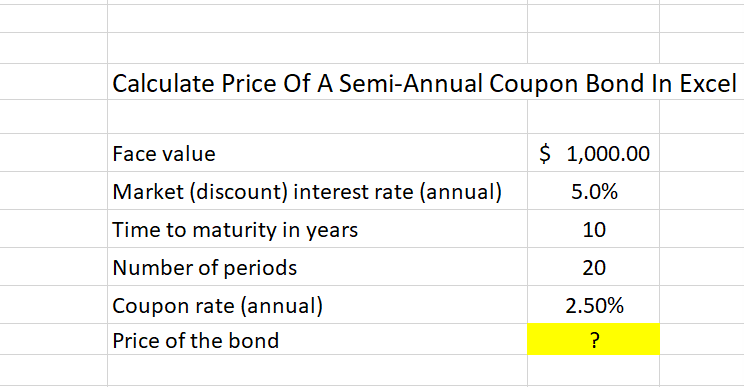

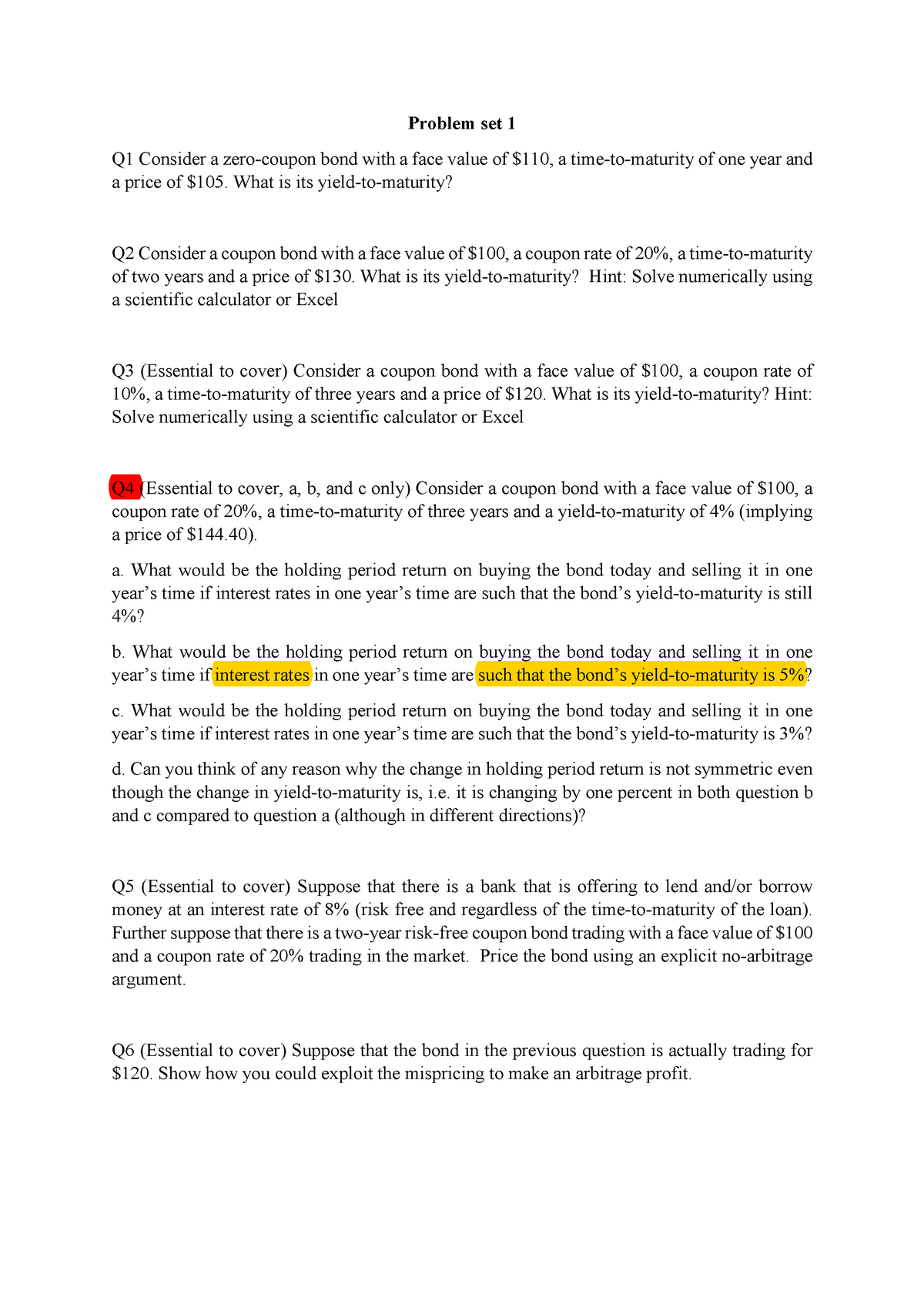

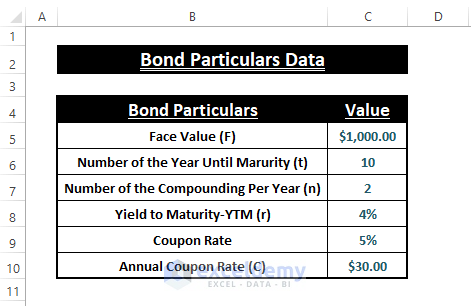

› coupon-rate-formulaCoupon Rate Formula | Calculator (Excel Template) - EDUCBA Step 3: In the final step, the amount of interest paid yearly is divided by the face value of a bond in order to calculate the coupon rate. Examples of Coupon Rate Formula (With Excel Template) Let’s take an example to understand the calculation of the Coupon Rate formula in a better manner. How to Calculate Bond Price in Excel (4 Simple Ways) Zero-coupon bond price means the coupon rate is 0%. Type the following formula in cell C11. = (C5/ (1 + (C8/C7))^ (C7*C6)) Press the ENTER key to display the zero-coupon bond price. Read More: How to Calculate Coupon Rate in Excel (3 Ideal Examples) Method 2: Calculating Bond Price Using Excel PV Function

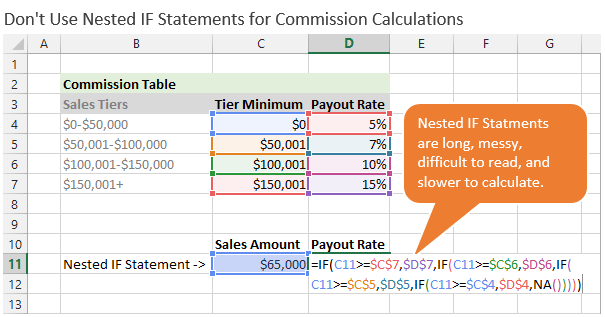

› functions › calculateHow to Calculate Commissions in Excel with VLOOKUP Jul 16, 2020 · We can use a VLOOKUP formula to calculate the payout rate for a given sales amount (lookup value). For this to work we need to set the last argument in the vlookup [range_lookup] to TRUE. With the last argument set to TRUE, vlookup will find the closest match to the lookup value that is less than or equal to the lookup amount .

Calculate coupon rate in excel

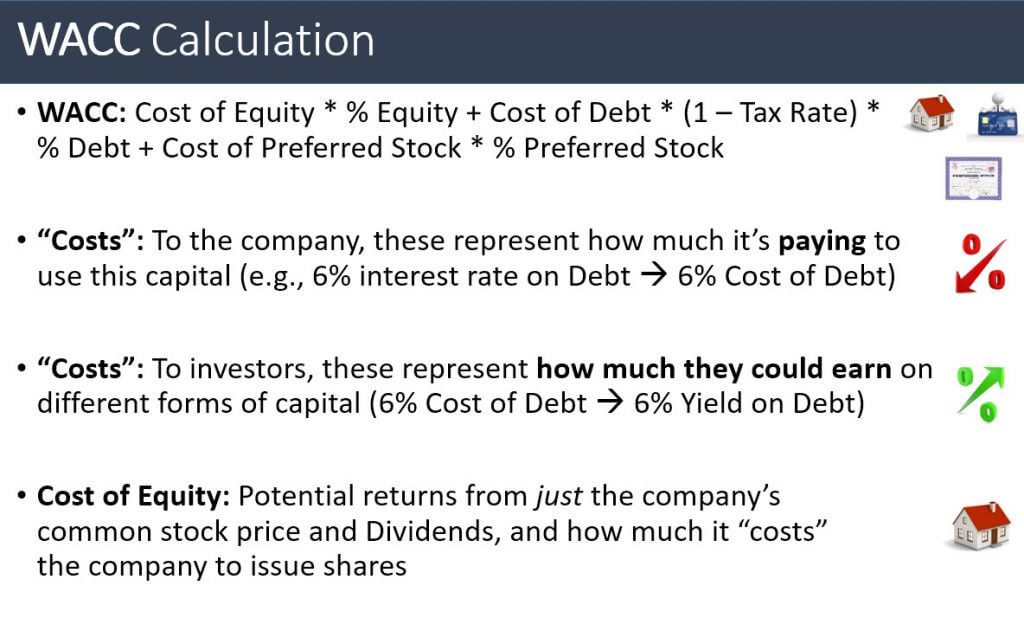

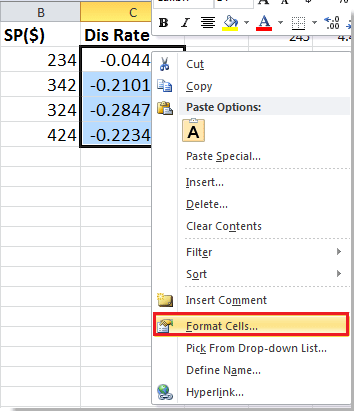

How to Calculate Coupon Rate in Excel (3 Ideal Examples) In Excel, we can also calculate the coupon bond using a formula. A coupon bond generally refers to the price of the bond. To calculate the coupon bond, we need to use the formula below. Coupon Bond = C* [1- (1+Y/n)^-n*t/Y]+ [F/ (1+Y/n)n*t] Here, C = Annual Coupon Payment Y = Yield to Maturity F = Par Value at Maturity › ask › answersHow Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia Jul 28, 2022 · However, calculating the coupon rate using Microsoft Excel is simple if all you have is the coupon payment amount and the par value of the bond. What Is the Coupon Rate? First, a quick definition ... breakingintowallstreet.com › how-to-calculateHow to Calculate Discount Rate in a DCF Analysis How to Calculate Discount Rate in Excel: Starting Assumptions. To calculate the Discount Rate in Excel, we need a few starting assumptions: The Cost of Debt here is based on Michael Hill’s Interest Expense / Average Debt Balance over the past fiscal year. That’s 2.69 / AVERAGE(35.213,45.034), so it’s 6.70%. here.

Calculate coupon rate in excel. successessays.comSuccess Essays - Assisting students with assignments online Calculate the price. Type of paper. Academic level. Deadline. Pages (275 words) How to calculate bond price in Excel? - ExtendOffice Select the cell you will place the calculated result at, type the formula =PV (B11,B12, (B10*B13),B10), and press the Enter key. See screenshot: Note: In above formula, B11 is the interest rate, B12 is the maturity year, B10 is the face value, B10*B13 is the coupon you will get every year, and you can change them as you need. Coupon Rate Calculator | Bond Coupon Calculate the coupon rate The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. › documents › excelHow to calculate discount rate or price in Excel? - ExtendOffice Calculate discount rate with formula in Excel. The following formula is to calculate the discount rate. 1. Type the original prices and sales prices into a worksheet as shown as below screenshot: 2. Select a blank cell, for instance, the Cell C2, type this formula = (B2-A2)/ABS (A2) (the Cell A2 indicates the original price, B2 stands the sales ...

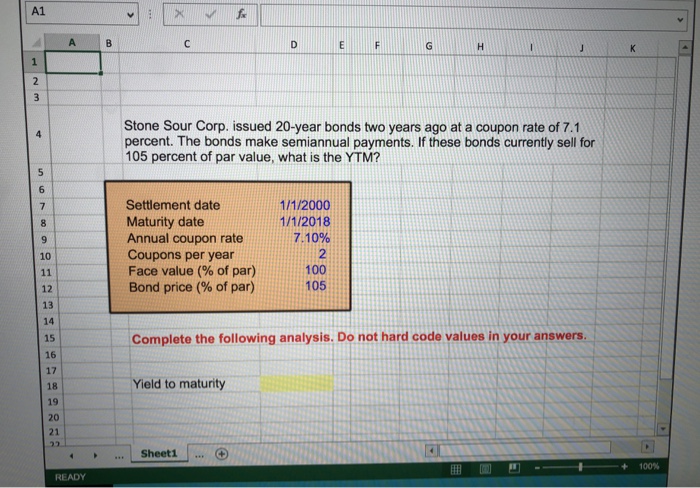

Zero Coupon Bond Calculator - Nerd Counter The upper mentioned $323.01 is the actual cost of the 10 years' maturity coupon with a 20% interest rate and $2000 face rate. There is another zero-coupon bond example if the face value is $4000 and the interest rate is 30%, and we are going to calculate the price of a zero-coupon bond that matures in 20 years. How to calculate Spot Rates, Forward Rates & YTM in EXCEL For example you have been given forward rates as follows: f 0,1 = 11.67% f 1,2 = 12.33% f 2,3 = 12.55% f 3,4 = 12.89% f 4,5 = 13.00% The 5-year spot rate, s 5, will be: [ (1+11.67%)× (1+12.33%)× (1+12.55%)× (1+12.89%)× (1+13.00%)] 1/5 -1 = 12.49% You may calculate this in EXCEL in the following manner: Coupon Rate Template - Free Excel Template Download Coupon Rate Formula The formula for calculating the coupon rate is as follows: Where: C = Coupon rate I = Annualized interest P = Par value, or principal amount, of the bond More Free Templates For more resources, check out our business templates library to download numerous free Excel modeling, PowerPoint presentation, and Word document templates. What is Coupon Rate? (Formula + Calculator) - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon ÷ Par Value of Bond For example, if the interest rate pricing on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6%

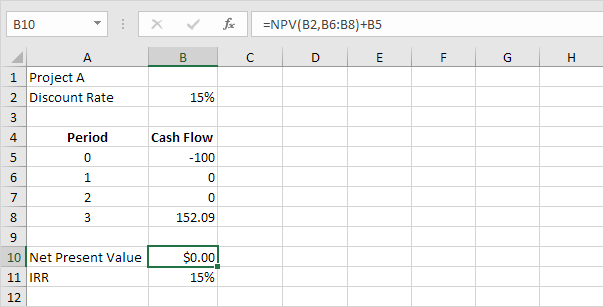

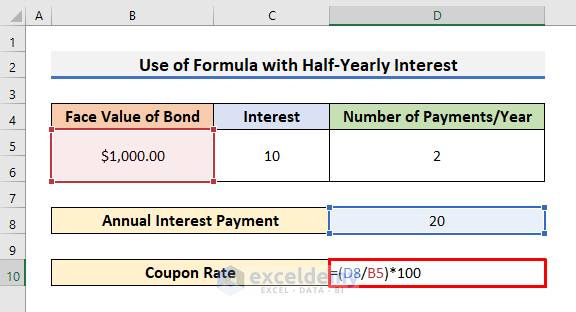

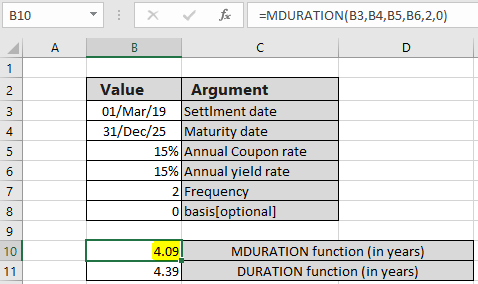

Coupon Payment Calculator You can quickly calculate the coupon payment for each payment period using the coupon payment formula: Coupon payment = face value * (annual coupon rate / number of payments per year) = $1,000 * (10% / 2) = $1,000 * 5% = $50 RATE function - Microsoft Support RATE is calculated by iteration and can have zero or more solutions. If the successive results of RATE do not converge to within 0.0000001 after 20 iterations, RATE returns the #NUM! error value. Syntax RATE (nper, pmt, pv, [fv], [type], [guess]) Note: For a complete description of the arguments nper, pmt, pv, fv, and type, see PV. Bootstrapping | How to Construct a Zero Coupon Yield Curve in Excel? Zero-Coupon Rate for 2 Years = 4.25%. Hence, the zero-coupon discount rate to be used for the 2-year bond will be 4.25%. Conclusion. ... Here we discuss how to construct a zero-coupon yield curve using bootstrapping excel examples along with explanations. You can learn more about fixed income from the following articles - › terms › iInternal Rate of Return (IRR) Rule: Definition and Example Aug 24, 2022 · Internal Rate of Return - IRR: Internal Rate of Return (IRR) is a metric used in capital budgeting to estimate the profitability of potential investments. Internal rate of return is a discount ...

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

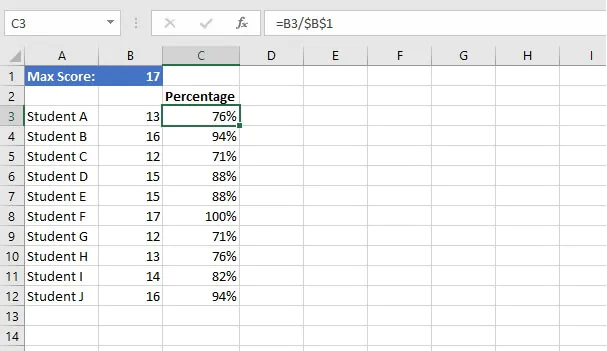

How to Calculate Discount in Excel: Examples and Formulas The steps to calculate the discount percentage in excel can be explained in detail as follows: Type the equal sign ( = ) in the cell where you want to put the discount percentage Type an open bracket sign then input the original price or the cell coordinate where the number is. Then, type a minus sign ( - )

Using Excel formulas to figure out payments and savings The PV function will calculate how much of a starting deposit will yield a future value. Using the function PV (rate,NPER,PMT,FV) =PV (1.5%/12,3*12,-175,8500) an initial deposit of $1,969.62 would be required in order to be able to pay $175.00 per month and end up with $8500 in three years. The rate argument is 1.5%/12.

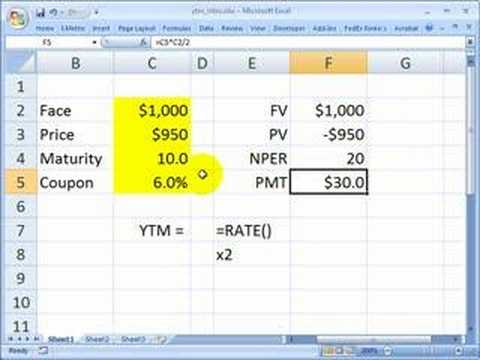

How to calculate YTM in Excel | Basic Excel Tutorial Steps to follow when calculating YTM in Excel using =RATE () Let us use these values for this example. You can replace them with your values. Face value =1000 Annual coupon rate =10% Years to maturity =10 Bond price =887. Now let us create the YTM using these values. 1. Launch the Microsoft Excel program on your computer. 2.

Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon (C) is calculated using the Formula given below C = Annual Coupon Rate * F C = (5%/2) * $1000 C = $25 Coupon Bond is calculated using the Formula given below Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] Coupon Bond = $25 * [1 - (1 + 4.5%/2) -16] + [$1000 / (1 + 4.5%/2) 16 Coupon Bond = $1,033

Calculate a Forward Rate in Excel - Investopedia This can be otherwise written as "= (100 x 1.04)" in Excel. It should produce $104. The final two-year value involves three multiplications: the initial investment, interest rate for the first...

Coupon Rate Formula | Step by Step Calculation (with Examples) Total annual coupon payment = Periodic payment * No. of payments in a year Finally, the coupon rate is calculated by dividing the total annual coupon payment by the par value of the bond and multiplied by 100%, as shown above. Examples You can download this Coupon Rate Formula Excel Template here - Coupon Rate Formula Excel Template Example #1

breakingintowallstreet.com › how-to-calculateHow to Calculate Discount Rate in a DCF Analysis How to Calculate Discount Rate in Excel: Starting Assumptions. To calculate the Discount Rate in Excel, we need a few starting assumptions: The Cost of Debt here is based on Michael Hill’s Interest Expense / Average Debt Balance over the past fiscal year. That’s 2.69 / AVERAGE(35.213,45.034), so it’s 6.70%. here.

› ask › answersHow Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia Jul 28, 2022 · However, calculating the coupon rate using Microsoft Excel is simple if all you have is the coupon payment amount and the par value of the bond. What Is the Coupon Rate? First, a quick definition ...

How to Calculate Coupon Rate in Excel (3 Ideal Examples) In Excel, we can also calculate the coupon bond using a formula. A coupon bond generally refers to the price of the bond. To calculate the coupon bond, we need to use the formula below. Coupon Bond = C* [1- (1+Y/n)^-n*t/Y]+ [F/ (1+Y/n)n*t] Here, C = Annual Coupon Payment Y = Yield to Maturity F = Par Value at Maturity

:max_bytes(150000):strip_icc()/bonds_chart-5bfc2eff46e0fb0026020ff4.jpg)

Post a Comment for "45 calculate coupon rate in excel"